|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 13 Bankruptcy in Utah: A Comprehensive Guide

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy, often referred to as a wage earner's plan, allows individuals with regular income to develop a plan to repay all or part of their debts. This type of bankruptcy is particularly beneficial for those who wish to keep their property while catching up on overdue payments.

How it Differs from Chapter 7

Unlike Chapter 7 bankruptcy, which involves liquidating assets to pay off debts, Chapter 13 allows debtors to keep their assets and reorganize their debt into manageable payments over three to five years.

The Process of Filing for Chapter 13 Bankruptcy in Utah

- Credit Counseling: Before filing, individuals must complete a credit counseling course from an approved agency.

- File the Petition: The debtor must submit a petition with the Utah bankruptcy court, including detailed financial information.

- Repayment Plan: A proposed repayment plan is submitted, detailing how debts will be repaid.

- Confirmation Hearing: The court will hold a hearing to approve the repayment plan.

- Plan Execution: Once approved, the debtor makes payments to a bankruptcy trustee who then distributes the funds to creditors.

Eligibility and Requirements

To qualify for Chapter 13 in Utah, the individual must have a regular income and their secured and unsecured debts must be below certain thresholds. Additionally, they must have filed tax returns for the previous four years.

Benefits of Chapter 13

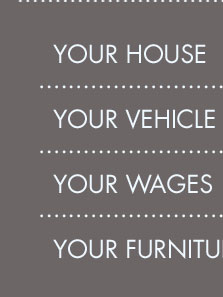

- Asset Retention: Debtors can keep their home and car.

- Debt Consolidation: Combines debts into a single monthly payment.

- Stop Foreclosure: Can halt foreclosure proceedings on a home.

Comparing with Other States

Filing for bankruptcy varies by state due to different laws and exemptions. For instance, when filing bankruptcy in CT, the process and exemptions may differ significantly from those in Utah, highlighting the importance of understanding local regulations.

Common Concerns and Misconceptions

Many people worry that filing for Chapter 13 will ruin their credit forever. While it does affect credit scores, it also provides a path to financial recovery and stability, which can eventually lead to improved creditworthiness.

FAQ

Can I convert my Chapter 13 bankruptcy to Chapter 7?

Yes, you can convert a Chapter 13 case to Chapter 7 if you qualify under the means test and meet other criteria.

What happens if I miss a payment?

Missing a payment can lead to dismissal of your case or conversion to Chapter 7. It’s crucial to contact your trustee immediately if you face difficulties in making payments.

How long does Chapter 13 bankruptcy stay on my credit report?

Chapter 13 bankruptcy can remain on your credit report for up to seven years from the filing date.

For those considering different states, when filing bankruptcy in SC, it's essential to consult with a local attorney to navigate state-specific laws and processes effectively.

Under Chapter 13 bankruptcy, debtors propose a repayment plan to make installments to creditors. If the court approves the plan, creditors are prohibited from ...

Chapter 13 Plans must run no less than 36 months and no longer than 60 months. If your disposable income exceeds the medium, Utah law requires that the plan ...

Effective 7/1/2014, for those who file petitions under chapter 7 or 13 seeking authority to pay the filing fee in installments, an initial minimum ...

![]()